Artificial Intelligence, today, has become a natural force, driving only the intelligent industries forward. From scanning medical images to predicting credit risk, AI-powered apps are transforming how people act with data. Once a machine learns human behavior, the machine is more efficient, and the result is astonishingly accurate.

According to a 2025 report by McKinsey, nearly $4.4 trillion will be added to GDP around the world if all industries adopt AI technology. While it makes our lives simpler, it also demands that industries innovate, adapt, and trust these intelligent systems.

The AI Revolution Across Industries

AI is the invisible thread that now injects intelligence into every digital activity, from hospitals to hedge funds. Already, the majority of the global enterprises are using AI applications. It is helping them in;

- Predictive Modelling:

Algorithms now predict human behavior in a multitude of ways, from the possibility of a disease to stock fluctuations. With this insight, organizations can plan for the future, improve their accuracy, and provide preventive care.

- Smart Automation:

Routine tasks are replaced by intelligent workflows. They prompt specific tasks within our workflow and correct themselves based on efficiency and inputs. This consistent automation nearly eliminates redundant manual work and speeds up the process.

- Personalization:

Systems are tailoring our experiences in an ongoing manner. They are adjusting the outputs not only based on behavior, but also based on time of day and emotional tone. This makes conversations fruitful, confident, while keeping the assurance of secrecy via encryption.

How AI-Powered Apps are Revolutionizing Healthcare

AI is helping the healthcare industry to offer predictive care rather than reactive care. It is helping healthcare professionals to offer preventive care that too, by considering the personal history of the patient. AI-powered healthcare apps are bringing revolution in the healthcare industry in the following ways;

- Early Disease Detection:

With smart AI diagnostic tools, it is now possible to detect the early traces of cancer or Alzheimer’s way earlier. With around maximum accuracy in radiology scans, these tools are detecting diseases and offering early detection.

- Remote Monitoring and Telemedicine:

Wearable devices linked to an app are providing real-time patient information. They are helping health professionals to measure the patient’s heart rate, blood sugar, as well as oxygen levels.

- Customized Treatment Plans:

Machine learning algorithms promote incremental and therapeutic treatment for better well-being. These treatments can also change and adapt according to the patient’s recovery, genetics, and environmental changes.

- Support for Mental Health:

AI chatbots provide CBT-informed counseling 24/7, especially for those seeking health advice remotely. People are using AI-based healthcare apps for counselling and suggestions to better manage mental stress and depression.

- Predictive Data Analytics:

Hospitals are utilizing data models to predict patient surges. This helps them to offer better resource utilization and minimize treatment delays even in an emergent situation.

As much as it is changing the healthcare space, artificial intelligence in the fintech industry is also driving revolution.

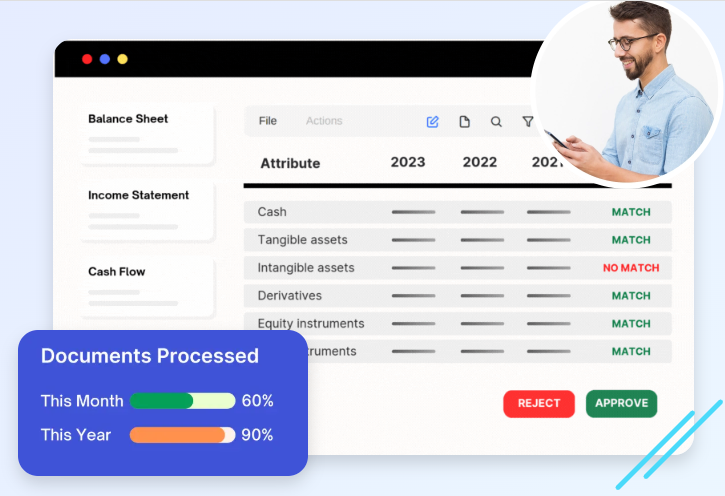

How AI-Powered Apps are Reinventing Fintech

In the fintech space, AI is not simply enabling automation. Here, AI is enabling trust, precision, and inclusion that could potentially reach a massive scale of profit. Right from analyzing huge data, AI is helping in identifying potential risk factors and helping financial sectors better manage risks.

- Fraud Detection and Risk Scoring:

AI can look for anomalies related to spending patterns (and other behaviors that are also suspicious) in millions of financial transactions all at once, in real time. Banks that have deployed fintech app development Dubai indicated that their rate of false fraud alerts has decreased, leading to an increase in consumer confidence and lower costs.

- Credit Underwriting:

AI-enabled lending platforms typically leverage alternative data sources (ex., mobile payment histories, e-commerce purchase activities, etc.). This provides a better indication of the creditworthiness of an individual. This enables access to affordable and more accessible financial services for those in the “credit invisible” category.

- Robo-Advisory and Portfolio Optimization:

AI-supported robo-advisors evaluate the user’s financial objectives, their risk tolerances, and current market activity. This helps them formulate an individualized portfolio for each unique user. They proactively optimize and rebalance the allocations to deliver an even greater expected return with no embedded conscious or unconscious biases.

- Personal Banking:

AI fintech, AI Chatbot Development Services and smart assistants who can tell about their users’ financial behaviors to better anticipate their everyday financial needs. This new technology offers users insights into their financial behavior, reminders to pay bills, and suggestions for savings.

- Algorithmic Trading:

An AI trading platform can understand and assess news sentiment and social sentiment on both uptrends and downtrends. There is no competition for the level of data they can analyze to interpret volatility and offer a sense of security during trades.

Conclusion

Though nearly every sector is availing the benefits of AI, Healthcare Software Development and AI fintech companies are especially leveraging this technology. Their successful adaptation with AI is bringing revolution for the physical, mental as well as financial wellbeing of people today.